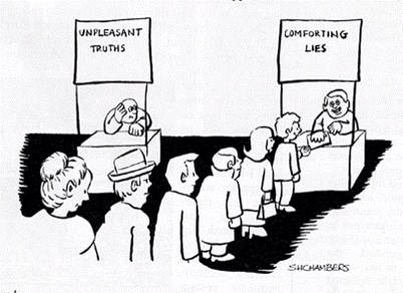

What economics lacks is the space to include other human sciences such as philosophy in the scope of its subject matter. Philosophy has the grand vision that is usually lacking in economics, which is all too often a science of the minutiae of life. One concept outside the understanding of economists is Hegel’s zeitgeist or the spirit of the age. What Hegel means by this is that there is one overall idea that animates a period of human history. It is an idea which expresses the characteristics of an age, such as the ‘bélle époque’ of 19th century Paris. A Paris of the freeing of human spirit, painting was freed from the old conventions demonstrated in the art of the impressionists, the vitality of popular culture was epitomised by the exuberance of the ‘Can Can’ yet this was a freeing that also allowed the darker side of the human spirit, corruption and venality to thrive. French politics of this time was characterised by a series of corruption scandals. As a believer in the zeitgeist, I wondered what was the spirit of this age? What was the spirit that informed human behaviours in our contemporary world?

Usually this is seen as the age of Neo-Liberalism , yet that phrase needs explaining. According to its advocates the freeing of the markets will lead to a freeing of the human spirit. Yet the art of the age does not seem to embody the freedom of the human spirit, rather it embodies the spirit of reproduction or copying. One art work that epitomises this spirit of reproduction is an art work by Damien Hirst, it was a series of dots on a white background. These dots varied only in colour but not in any other way. They seemed to have been placed in lines on the screen only the colours of the dots seemed to be chosen at random. I as a viewer could see little creativity at work, it was a machine like picture, a picture that for me could only be produced by a machine. What it lacked was the spark of human imagination. Damien Hirst work demonstrative of an age that is lacking in originality and creativity. A lack of originality that can be seen on any new housing estate, which consists of houses which are copies of those built for generations by the builder’s predecessors. They are inferior copies of the house of the past as they are being built of inferior materials and to much smaller dimensions. Houses that were built according to a least cost formula, a least cost that necessarily implies a lack of originality. Why go for the expense course of employing an architect to create a contemporary house incorporating new materials and bold design, when it is cheaper and easier to copy an old design?

What Neo-Liberalism has given to the age is a dominant mode of thought. Policy decisions are not to be made of according to values or any grand vision but according to a cost benefit calculation. A government project such as the High Speed Rail link from London to the North is made on this basis. Do the demonstrated costs outweigh the benefits in cash terms? This leads to all sorts of strange calculations to render values such the enjoyment of living in the undisturbed countryside in cash terms. Decisions can only be made on quantifiable or cash terms, this thinking leads to a diminution of the human spirit, as decision making is reduced to a process of calculation. Human values have been reduced to a simple cash nexus, it is a corruption of the human spirit.

It is a world in which the heroes are the bankers and speculators, those who are the masters money. There heroic status derives from the fact that they handle vast quantities of money, money a product which is the holy grail of contemporary society, in that those who are greatest possess the most of this asset. We know a footballer is a footballing genius as much through the income he commands as for his skill on the football pitch.

There is embodied in Neo-Liberal philosophy a realism of the most naive form. What is valued is what is tangible, what can be counted and weighed, not abstraction? There is the belief that abstract universal values have no place in contemporary society. What counts is the practicality of a belief or ideology. Neo-Liberalism is the most practicable of beliefs in that only those outcomes that can be quantified, the benefits be counted, are valued. Only those practices that have a quantifiable end result matter. The result is the target culture in the public sector, where performance is measured in terms of targets achieved. The emphasis is on ‘through put’ not on quality. In hospitals the target culture has damaged good practice. What matters is that the target is met, not the quality of service. This results in some bizarre practices, because there is a time limit set for treating patients in Accident and Emergency (A&E), patients will be deliberately kept waiting in ambulances, as by so doing the patient has not yet been admitted to A& and is not counted as an in patient. This means that the time they spent waiting in the ambulance does not count when it comes to measuring how successful the A&E department has been in meeting its performance targets.

One of the most damaging aspects of the Neo-Liberal zeitgeist is to found in our schools. What is causing great excitement is the new stem subjects, the officially defined list of subjects in which students are expected to do well? These stem subjects are little more than a sophisticated version of the 3 r’s ‘reading, ‘riting and ‘rithmetatic’ that formed the curriculum of many state schools in the 19th century. Dickens’ Wackford Squeers would feel very much at home in the new academies. This change has happened because schools are now measured by output. The output that matters is in that of the skills that business wants. Businessman want employees that are competent in the 3 r’s, if they do want painters it is a painter who can paint a wall, not an artist. There is in our schools a deskilling and narrowing of the curriculum. A deskilling in all that matters is those skills that can be quantified and measured, so creativity achieves a zero score while the rote repetition of the agreed answer gets the highest score.The narrowing the curriculum is caused by the downgrading of the creative arts, that is art, music and drama get few marks in the current system, so headteachers that wish to do well, discourage their brightest students from doing anything but the stem subjects. There cannot have been a curriculum more designed to create a dull, boring and miserable education for children than the current one.

When economists look for reasons for the poor performance of the economy, the look the reasons that do not relate to the human spirit. The reigning zeitgist is one that is unimaginative, it only values the measurable and is one of uninspiring dullness.A corruption of the human spirit, one that discourages all that is best in the human personality. Are not some of the failings of the British economy to be found in a zeitgeist that discourages innovation and creativity. If economists raised their eyes from their desks they might see that there are studies pointing them in this direction. A recent study of the booming computer software industry in East London showed that one of the reasons for its success was that it was perceived as a ‘cool’ place to work and live and as a consequence attracts some of the best computer software engineers in Europe. Rather than worrying about how to make workers more productive, perhaps economists should look more to creating a zeitgeist that encouraged creativity and innovation. A zeitgeist that would drag the society out of its current doldrums.