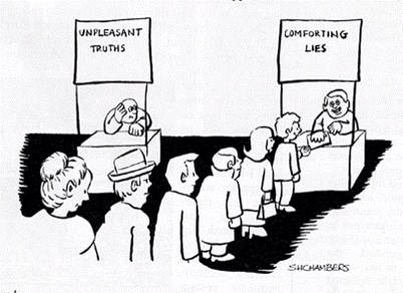

The sudden rush of enthusiasm for war in Syria made me realise that there is no commentary on the economics of war and war making. What I don’t intend to do is repeat the moral and political arguments on the subject of war making, which others are better qualified to make. The question that I want to answer can economics justify war, is there an economic equivalent of the churches ‘just war’? (As defined by St.’s Augustine and Thomas Aquinas)

Image of Syrian War taken from Geopoliticsmadesuper.com

The first thing to note is that there is a peculiarity embedded in the economics of war making. All war materials be they planes or tanks are built to be destroyed. Each item will be used repeatedly until it is either no longer fit for purpose or destroyed by enemy action. War weapons are a very poor investment one that adds little to the wealth of the community. This represents a problem for accountants and economists, how do you value an asset whose only purpose is to be destroyed? The simple answer is that these war weapons are valued according to their cost of production, they can add nothing to the future wealth of society.

There is another strange feature of war weapons that represent their paradoxical nature. They are designed not to be used, the best weapons are those which are an effective deterrent to war. One such weapon is the Trident nuclear weapons system, it works if it’s never used. The government’s of the sixty years have invested vast amounts of money into a product that has never been used. It cannot be stated often enough that the best weapons are those that are never used. This was a policy practised by the British Empire in the 19th century, it always had a fleet of warships that was at least twice the size of twice the size of its rivals. No rival power ever threatened the Empire, because it risked the annihilation of their navy. Trident as a weapon of mass destruction is unparalleled as a weapon of deterrence. Perhaps this is the only occasion in which vast amounts of resources and time is spent on a product that is intended never to be used.

Although military men might object, this is where marketing proves invaluable. It is very rare for these weapons to work as described. One version of the Trident missile was rumoured to be equipped with war heads that could malfunction when in action. There was the Lockheed Starfighter nicknamed the flying coffin because of the regularity with which it fell out of the sky. There are numerous other examples of under performing expensive weapons of war, but the military of both sides keep to the pretence that their weapon systems their super weapons work perfectly well. Given the success of the intelligence services of both sides in discovering the military secrets of their rivals, they must know about the underperformance of their rivals weapons systems but prefer to keep quiet. There is an omertà in the world’s military one that prevents them ever being honest about the poor performance of their weapons systems because that would undermine their credibility as masters of war.There are no marketing men in existence as effective as the generals when it comes to marketing a dud product.

This is another strangeness of the war market, while military men claim to be men of action, they are more accurately termed men of inaction. The most successful ones never have to do the task for which they are paid. What the good general most wants to do is avoid action and the destruction of much of his military assets. A philosophy best demonstrated in medieval warfare. Then a battle would involve such huge loss of life, that each army would usually lose a third of their manpower in battle, more in the losing army. Therefore medieval monarchs tried to avoid open battle as it would leave their army so depleted that it would be unable to fight another war. When Henry V left France in 1405, the army that remained was so depleted that it was unfit for any further battle. Only the weakness of the French acing lost the Battle of Agincourt, kept this weakened army safe from attack and destruction.

On occasions military men forget the first rule of war, that is not making war. The most recent example was the war on Iraq. There were a number of senior officials and generals in the Pentagon who were eager to test their new weapons of war in combat. War technology was so far advanced in America that these men were eager to test their weapons in combat. While there were other reasons for the Iraq war, the American military and Pentagon officials were desperate for an opportunity to play with their new weapons. When it came to war, American technology was so superior that the war was over in a matter of weeks. However it later turned out that victory was due less to superior weapons technology and more to old fashioned bribery. The Americans had paid the generals of the elite Republican Guard not to fight. The chaos that has been Iraq since 2003 demonstrates why it is foolish to regard the military option as the first and best option. When leaving the Oval Office in 1961 President Eisenhower warned of the danger posed by the ‘military industrial complex’ a danger shown by the Iraq war when the arms salesman were able to push America into a costly and pointless war.

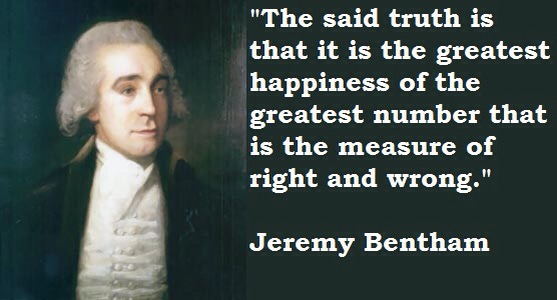

This leads to the first rule of the economics of war, never engage in a war unless the enemy poses an existential threat as the destruction of resources and human life is so that war can never be justified for any other reason. As a British citizen the war against Hitler can be justified as it presented an existential threat to the UK, the wars in the Falklands, Afghanistan and Iraq cannot be justified.

History provides examples of why war is such a bad investment, it is their huge cost. Recently I read a history of Edward I. He was a successful war leader constantly beating his Welsh and Scottish adversaries, yet time and time again his campaigns ground to a halt when he ran out of money. What usually happened was the foot soldiers who made up the majority of the army would desert when the campaign was well under way and approaching a successful conclusion, because they had not been paid. All medieval monarchs were in debt to their bankers, because of the huge sums they had borrowed to fight wars. Today it’s little different money borrowed to finance the campaigns in Iraq, Afghanistan and Syria will be paid by our grandchildren. When I was a student in the 1960s, I was told that the country was still paying for the Crimean War, a war that was fought in the 1850s. War is a fantastically expensive enterprise for which their is little return.

As a sceptical economist I doubt the value of making huge investments in products that either will never be used or if used destroyed in combat. If I heard the new correctly our government is preparing to invest in a fleet of new fighter planes the F35 at a cost of £100 million a plane. I cannot as an economist see the utility or purpose of investing £10 billion in a product that only has one purpose which is to be destroyed. The cost of the new Trident missile system is estimated at £100 billion or just less than 10% of our annual national income. Why I don’t dispute the value of deterrence in an irrational world I do wonder if it needs to cost so much. Is their an inverse logic that applies to military thinking, which simply stated means the more that is paid for war weapons the more utility and value they possess regardless of their effectiveness? It is often said of the British military that they want gold plated weapons systems. The British and European government’s spent billions developing a warplane that had such poor flying characteristics that it was nicknamed the ‘flying sow’.

There can only be one somewhat nonsensical conclusion, the government has to invest in a product they never intend to use or hope never to use. The investment in military hardware must be sufficient to deter possible aggressors yet never be such as to bankrupt the economy. Perhaps the ideal situation occurred during the Cold War when both the USA and the Soviet Union invested billions in a weapon they never wanted to use, that is the nuclear deterrent. However peace was maintained only at the price of mutually assured destruction (MAD). This however was far from ideal as in the case of the Iraq war warriors, if one group of leaders thought they possessed an advantage over the others, they could be tempted to use their weapons of mass destruction. Perhaps the only solution is for the leaders of the most technologically advanced nation to limit their military superiority over others so no future leaders are tempted to use those weapons in a pre-emotive strike.

The first thing to note is that there is a peculiarity embedded in the economics of war making. All war materials be they planes or tanks are built to be destroyed. Each item will be used repeatedly until it is either no longer fit for purpose or destroyed by enemy action. War weapons are a very poor investment one that adds little to the wealth of the community. This represents a problem for accountants and economists, how do you value an asset whose only purpose is to be destroyed? The simple answer is that these war weapons are valued according to their cost of production, they can add nothing to the future wealth of society.

There is another strange feature of war weapons that represent their paradoxical nature. They are designed not to be used, the best weapons are those which are an effective deterrent to war. One such weapon is the Trident nuclear weapons system, it works if it’s never used. The government’s of the sixty years have invested vast amounts of money into a product that has never been used. It cannot be stated often enough that the best weapons are those that are never used. This was a policy practised by the British Empire in the 19th century, it always had a fleet of warships that was at least twice the size of twice the size of its rivals. No rival power ever threatened the Empire, because it risked the annihilation of their navy. Trident as a weapon of mass destruction is unparalleled as a weapon of deterrence. Perhaps this is the only occasion in which vast amounts of resources and time is spent on a product that is intended never to be used.

Although military men might object, this is where marketing proves invaluable. It is very rare for these weapons to work as described. One version of the Trident missile was rumoured to be equipped with war heads that could malfunction when in action. There was the Lockheed Starfighter nicknamed the flying coffin because of the regularity with which it fell out of the sky. There are numerous other examples of under performing expensive weapons of war, but the military of both sides keep to the pretence that their weapon systems their super weapons work perfectly well. Given the success of the intelligence services of both sides in discovering the military secrets of their rivals, they must know about the underperformance of their rivals weapons systems but prefer to keep quiet. There is an omertà in the world’s military one that prevents them ever being honest about the poor performance of their weapons systems because that would undermine their credibility as masters of war.There are no marketing men in existence as effective as the generals when it comes to marketing a dud product.

This is another strangeness of the war market, while military men claim to be men of action, they are more accurately termed men of inaction. The most successful ones never have to do the task for which they are paid. What the good general most wants to do is avoid action and the destruction of much of his military assets. A philosophy best demonstrated in medieval warfare. Then a battle would involve such huge loss of life, that each army would usually lose a third of their manpower in battle, more in the losing army. Therefore medieval monarchs tried to avoid open battle as it would leave their army so depleted that it would be unable to fight another war. When Henry V left France in 1405, the army that remained was so depleted that it was unfit for any further battle. Only the weakness of the French acing lost the Battle of Agincourt, kept this weakened army safe from attack and destruction.

On occasions military men forget the first rule of war, that is not making war. The most recent example was the war on Iraq. There were a number of senior officials and generals in the Pentagon who were eager to test their new weapons of war in combat. War technology was so far advanced in America that these men were eager to test their weapons in combat. While there were other reasons for the Iraq war, the American military and Pentagon officials were desperate for an opportunity to play with their new weapons. When it came to war, American technology was so superior that the war was over in a matter of weeks. However it later turned out that victory was due less to superior weapons technology and more to old fashioned bribery. The Americans had paid the generals of the elite Republican Guard not to fight. The chaos that has been Iraq since 2003 demonstrates why it is foolish to regard the military option as the first and best option. When leaving the Oval Office in 1961 President Eisenhower warned of the danger posed by the ‘military industrial complex’ a danger shown by the Iraq war when the arms salesman were able to push America into a costly and pointless war.

This leads to the first rule of the economics of war, never engage in a war unless the enemy poses an existential threat as the destruction of resources and human life is so that war can never be justified for any other reason. As a British citizen the war against Hitler can be justified as it presented an existential threat to the UK, the wars in the Falklands, Afghanistan and Iraq cannot be justified.

History provides examples of why war is such a bad investment, it is their huge cost. Recently I read a history of Edward I. He was a successful war leader constantly beating his Welsh and Scottish adversaries, yet time and time again his campaigns ground to a halt when he ran out of money. What usually happened was the foot soldiers who made up the majority of the army would desert when the campaign was well under way and approaching a successful conclusion, because they had not been paid. All medieval monarchs were in debt to their bankers, because of the huge sums they had borrowed to fight wars. Today it’s little different money borrowed to finance the campaigns in Iraq, Afghanistan and Syria will be paid by our grandchildren. When I was a student in the 1960s, I was told that the country was still paying for the Crimean War, a war that was fought in the 1850s. War is a fantastically expensive enterprise for which their is little return.

As a sceptical economist I doubt the value of making huge investments in products that either will never be used or if used destroyed in combat. If I heard the new correctly our government is preparing to invest in a fleet of new fighter planes the F35 at a cost of £100 million a plane. I cannot as an economist see the utility or purpose of investing £10 billion in a product that only has one purpose which is to be destroyed. The cost of the new Trident missile system is estimated at £100 billion or just less than 10% of our annual national income. Why I don’t dispute the value of deterrence in an irrational world I do wonder if it needs to cost so much. Is their an inverse logic that applies to military thinking, which simply stated means the more that is paid for war weapons the more utility and value they possess regardless of their effectiveness? Is price becoming the new deterrent? It is often said of the British military that they want gold plated weapons systems. The British and European government’s spent billions developing a warplane that had such poor flying characteristics that it was nicknamed the ‘flying sow’.

There can only be one somewhat nonsensical conclusion, the government has to invest in a product they never intend to use or hope never to use. The investment in military hardware must be sufficient to deter possible aggressors yet never be such as to bankrupt the country.Perhaps the ideal situation occurred during the Cold War when both the USA and the Soviet Union invested billions in a weapon they never wanted to use, that is the nuclear deterrent. However peace was maintained only at the price of mutually assured destruction (MAD). This however was far from ideal as in the case of the Iraq war warriors, if one group of leaders thought they possessed an advantage over the others, they could be tempted to use their weapons of mass destruction. Perhaps the only solution is for the leaders of the most technologically advanced nation to limit their military superiority over others so no future leaders are tempted to use those weapons in a pre-emotive strike.